Interim results for the six months ended June 30, 2025

September 12, 2025

Biodexa Pharmaceuticals PLC

(“Biodexa” or the “Company”)

Interim results for the six months ended June 30, 2025

Biodexa Pharmaceuticals PLC (Nasdaq: BDRX), a clinical stage biopharmaceutical company developing a pipeline of innovative products for the treatment of diseases with unmet medical needs, today announces its unaudited interim results for the six months ended June 30, 2025 which will also be made available on the Company’s website at www.biodexapharma.com.

OPERATIONAL HIGHLIGHTS

The Company announced the following in the six months ended June 30, 2025:

- Allowance by the US Patent and Trademark Office of patent application No. 17/391-495 “Oral Rapamycin Nanoparticle Preparations and Use”, exclusively licensed to the Company by Emtora Biosciences .

- Appointment of Precision for Medicine, LLC as the clinical research organization to conduct the European component of the upcoming registrational Phase 3 study of eRapa in FAP.

- A successful Type C meeting with the US Food and Drug Administration regarding the protocol for the Company’s registrational Phase 3 study of eRapa in FAP.

- Orphan Drug Designation granted for eRapa in FAP by the European Commission.

- Recruitment of the first patient in a Phase 2a study of tolimidone in Type 1 Diabetes in an Investigator Initiated Trial conducted by the University of Alberta Diabetes Institute.

- Selection of ‘Serenta’ as the brand name for its Phase 3 clinical study of eRapa in FAP together with launch of a dedicated website, www.serentatrial.com, to provide information and resources for patients, caregivers, and healthcare professionals.

- Activation of the first clinical study site in the US for its Serenta trial in patients with FAP.

Post period end:

- Filing of a Clinical Trial Application with the European Medicines Agency for its Serenta trial in patients with FAP.

- Enrolment of first patients in the Serenta trial by the Pan American Center for Oncology Trials in San Juan, Puerto Rico.

FINANCIAL HIGHLIGHTS

|

|

|

|

Commenting, Stephen Stamp, CEO and CFO, said “The first half was extremely productive. Having secured Fast Track designation and successfully negotiated our way through a Type C meeting with the FDA, in August we enrolled the first patients into our pivotal Serenta trial of eRapa in FAP. In parallel, we secured orphan designation from the European Commission for eRapa in FAP in Europe and filed a Clinical Trial Application with the EMA, which sets us up to begin enrolment in the Serenta trial in Europe in the fourth quarter”.

CHIEF EXECUTIVE’S REVIEW

Our main focus in the first half of 2025 was on preparatory activities for the start of our registrational Phase 3 trial of eRapa in Familial Adenomatous Polyposis (“FAP”).

R&D update

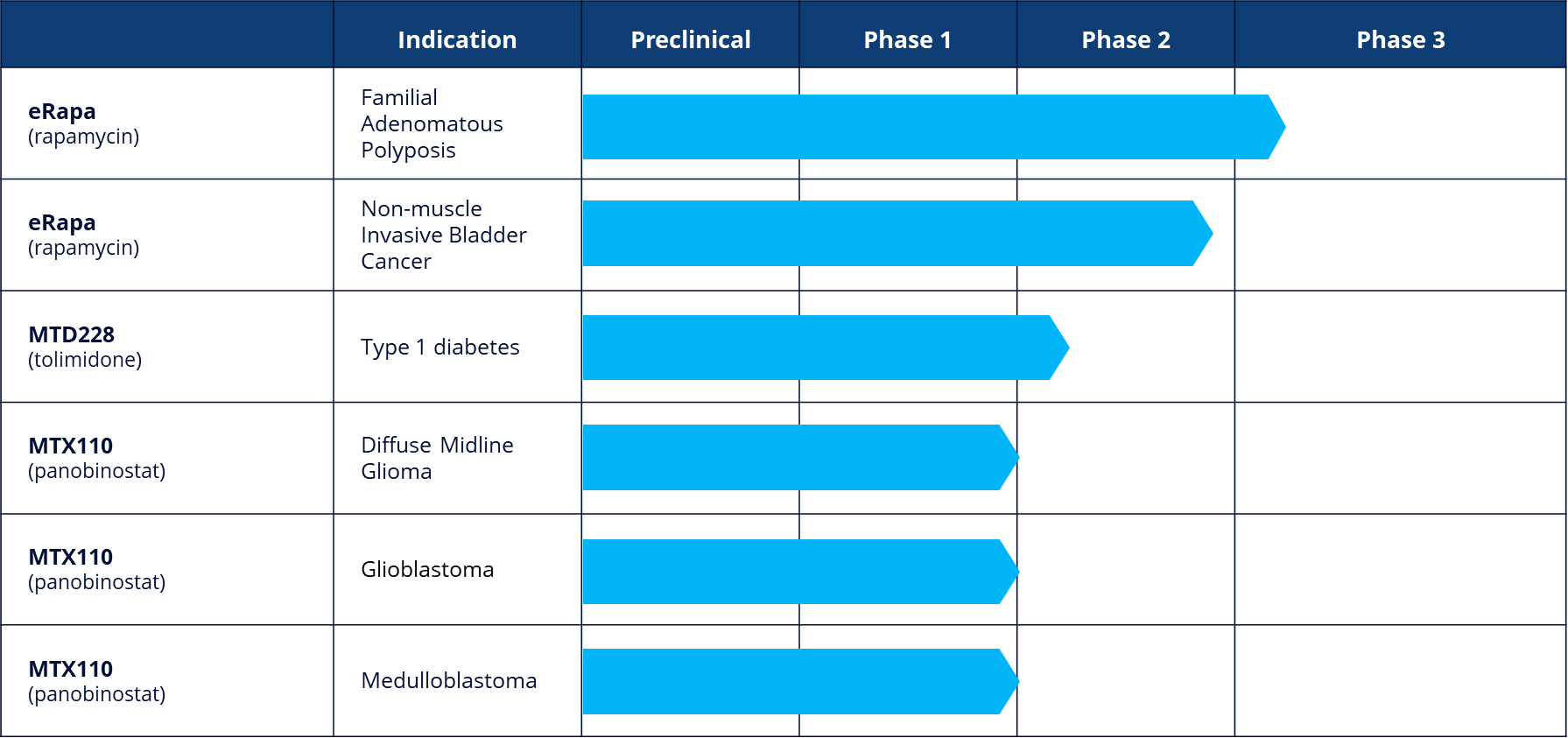

In the first half of 2025 we materially advanced our R&D pipeline, moving eRapa in FAP into Phase 3 and tolimidone for Type 1 Diabetes (“T1D) into Phase 2:

eRapa

eRapa is a proprietary oral formulation of rapamycin, also known as sirolimus. Rapamycin is an mTOR (mammalian Target Of Rapamycin) inhibitor. mTOR has been shown to have a significant role in the signalling pathway that regulates cellular metabolism, growth and proliferation and is activated during tumorgenesis. Rapamycin is approved in the US for organ rejection in renal transplantation as Rapamune®(Pfizer). Through the use of nanotechnology and pH sensitive polymers, eRapa is designed to address the poor bioavailability, variable pharmacokinetics and toxicity generally associated with the currently available forms of rapamycin. eRapa is protected by a number of issued patents which extend through 2035, with other pending applications potentially providing further protection beyond 2035.

Familial Adenomatous Polyposis (“FAP”)

FAP is an orphan indication characterized by a proliferation of polyps in the colon and/or rectum, usually occurring in mid-teens. There is no approved therapeutic option for treating FAP patients, for whom active surveillance and surgical resection of the colon and/or rectum remain the standard of care. If untreated, FAP almost always leads to cancer of the colon and/or rectum. There is a significant hereditary component to FAP with a reported incidence of one in 5,000 to 10,000 in the US and one in 11,300 to 37,600 in Europe. eRapa has received Orphan Designation in the US and in Europe. Importantly, mTOR has been shown to be over-expressed in FAP polyps – thereby underscoring the rationale for using a potent and safe mTOR inhibitor like eRapa to treat FAP.

An open-label Phase 2 study (NCT04230499) was conducted by Emtora in seven U.S. centres of excellence in 30 adult patients. Patients were sequentially enrolled into three dosing cohorts of 10 patients each for a 12-month treatment period: 0.5mg every other day (Cohort 1), 0.5mg daily every other week (Cohort 2), and 0.5mg daily (Cohort 3). Upper and lower endoscopic surveillance occurred at baseline and after six months. Primary endpoints were safety and tolerability of eRapa and percentage change from baseline in polyp burden, as measured by the aggregate of all polyp diameters.

In May 2024 and June 2024, results of the Phase 2 study at six months and 12 months, respectively, were presented at prestigious scientific meetings by Carol Burke, MD, the Principal Investigator. In summary, at six months, eRapa appeared safe and well-tolerated with a significant 24% reduction in the total polyp burden at six months compared with baseline and an overall 83% non-progression rate. At 12 months, 21 of 28 (75%) patients were deemed to be non-progressors with a median reduction in polyp burden of 17%. In Cohort 2, the dosage regimen for Phase 3, eight of nine (89)% of patients were deemed non-progressors at 12 months with a median reduction in polyp burden of 29%. Over the course of 12 months, there were four related Grade 3 or higher and one related Serious Adverse Event reported during the trial and 95% compliance rate at 12 months. One patient was removed from the trial due to non-compliance.

The Phase 3 registrational study (NCT06950385) is a double-blind placebo-controlled design, recruiting 168 high risk patients diagnosed with germline or phenotypic FAP. The primary clinical endpoint is first progression free survival event which will comprise composite endpoints including major surgery. We had a successful ‘Type C’ meeting with the FDA in January 2025 to finalise the protocol. The first clinical site was initiated in June 2025 and the first patients enrolled by the Pan American Center for Oncology Trials in San Juan, Puerto Rico in August 2025. Europe is following closely behind; our contract research organisation, Precision for Medicine, was appointed in March 2025. Orphan Drug Designation for eRapa in FAP was granted by the European Commission in May 2025. A Clinical Trial Application was filed with the European Medicines Agency for the Serenta trial in July 2025 which, if approved, will facilitate the start of patient recruitment in Europe in 4Q25.

Non-muscle Invasive Bladder Cancer (“NMIBC”)

NMIBC refers to tumors found in the tissue that lines the inner surface of the bladder. The most common treatment is transurethral resection of the bladder tumor followed by intravesical Bacillus Calmette-Guerin (“BCG”) with chemotherapy depending upon assessment of risk of recurrence. NMIBC is the fourth most common cancer in men with an incidence of 10.1 per 100,000 and 2.5 per 100,000 in women.

The ongoing multi-centre, double-blind, placebo-controlled Phase 2 study in NMIBC (NCT04375813) is fully enrolled at 166 patients with primary endpoints of safety/tolerability and relapse free survival after 12 months of treatment. The study, which is supported by a $3.0 million non-dilutive grant from the National Cancer Institute, part of the National Institutes of Health, was transferred to the University of Texas, San Antonio as an Investigator Initiated Trial and is expected to read out in mid-2026.

MTD228 - Tolimidone

Tolimidone was originally discovered by Pfizer and was developed through Phase 2 for the treatment of gastric ulcers. Pfizer undertook a broad pre-clinical program to characterize the pharmacology, pharmacokinetics, metabolism and toxicology of tolimidone. Pfizer discontinued development of the drug due to lack of efficacy for that indication.

Tolimidone is a selective activator of the enzyme Lyn kinase which increases phosphorylation of insulin substrate-1, thereby amplifying the signalling cascade initiated by the binding of insulin to its receptor.

Type 1 Diabetes (“T1D”)

Tolimidone’s potential utility in T1D has been demonstrated by several preclinical studies conducted by the University of Alberta, where Lyn kinase was identified as a key factor for beta cell survival and proliferation in in vitro and in vivo models. Most importantly, tolimidone appeared to induce proliferation in beta cells isolated from human cadavers. From a mechanism of action perspective, tolimidone has been shown to both prevent beta cell degradation and to stimulate beta cell proliferation. In a meta analysis of 1,202 articles and 193 studies, the incidence of T1D was shown to be 15 per 100,000 with a prevalence of 9.5 per 10,000 of the population.

As a first step in the continued clinical development of tolimidone, a Phase 2a Investigator Initiated Trial (IIT) at the University of Alberta Diabetes Institute (NCT06474598) is designed to establish the minimum effective dose of tolimidone in patients with T1D. The study, enrolled the first patient in June 2025 and is expected to recruit 12 patients initially across three dose groups. The study will measure C-peptide levels (a marker for insulin) and HbA1c (a marker for blood glucose) after three months compared with baseline and the number of hyperglycemic events.

MTX110

MTX110 is a solubilised formulation of the histone deacetylase (HDAC) inhibitor, panobinostat. This proprietary formulation enables delivery of the product via convection-enhanced delivery (CED) at chemotherapeutic doses directly to the site of the brain tumor, by-passing the blood-brain barrier and potentially avoiding systemic toxicity. All three types of brain cancer being studied are orphan.

Recurrent Glioblastoma (“rGBM”)

Our Phase 1 MAGIC-G1 study (NCT05324501) of MTX110 in rGBM has completed the dose escalation part of the study with the recruitment of the fourth patient in Cohort A. Overall survival was reported as between 11 and 12 months. Glioblastoma virtually always recurs with median Progression Free Survival of 1.5–6.0 months and median Overall Survival of 2.0–9.0 months.

Diffuse Midline Glioma (“DMG”)

In February 2024 we announced headline data from a Phase 1 IIT study conducted by Columbia University in newly diagnosed patients with DMG. As this was the first ever study of repeated infusions to the pons via an implanted CED catheter, the primary objective of the study was safety and tolerability and, accordingly, the number of infusions was limited to two, each of 48 hours, seven days apart in nine patients. One patient suffered a severe adverse event assessed by the investigators as not related to the study drug. Although not powered to reliably demonstrate efficacy, median Overall Survival of patients in the study was 16.5 months compared with median survival rate in a cohort of 316 cases of 10.0 months.

Study investigators subsequently presented the results of the trial at the 21st International Symposium on Pediatric Neuro-Oncology (ISPNO 2024) in Philadelphia, PA.

Medulloblastoma

An IIT Phase I study of MTX110 in medulloblastoma remains ongoing at the University of Texas.

Due to resource constraints, MTX110 has been de-prioritised and there are no current development activities being undertaken.

Financing

Equity Line of Credit

In January 2025, we entered into a securities purchase agreement, or equity line of credit (“ELOC”), with the newly formed C/M. Under the terms of the ELOC, we have the right, but not the obligation, to sell to C/M from time to time up to $35 million of newly issued ADSs over a 36-month period, unless the ELOC is terminated. As consideration for the execution and delivery of the ELOC, we agreed to pay a commitment fee (“Commitment Fee”) of $875,000 in cash, of which (i) $612,500 was to be paid to C/M on signing the ELOC and (ii) the balance was to be paid pro rata, simultaneously with the delivery of any ADSs sold under the ELOC. We had the right to issue ADSs representing the value of the applicable portion of the Commitment Fee. We paid the initial Commitment Fee of $612,500 through the issuance of 140,080 Depositary Shares to the Purchaser.

We may direct C/M to purchase a specified number of ADSs not to exceed $2.5 million on any given day, at a price based on a formula, typically 95% of the closing price on the prior day. As of June 30, 2025, the Company had raised gross proceeds of $8.56 million from the ELOC.

Warrant Inducement

In May 2025 we entered into letter agreements with certain holders of outstanding Series E, Series H, Series J and Series K warrants to reduce the exercise price of such warrants to $0.31 per share. The holders exercised an aggregate of 200,433 warrants representing the same number of ADSs. We received gross proceeds of approximately $62,000, before offering expenses. The Company did not issue new warrants to replace the exercised warrants and did not engage a placement agent to facilitate the transaction.

1H25 FINANCIAL REVIEW

The unaudited results for the six months ended June 30, 2025 are discussed below:

Key performance indicators (KPIs):

| 1H 2025 | 1H 2024 | Change | |

| R&D costs | £1.67m | £2.19m | (24)% |

| R&D as % of operating costs | 41% | 52% | (11)% |

| Net cash inflow/(outflow) for the period | £2.37m | £(0.92)m | N/M |

Biodexa’s KPIs focus on the key areas of operating results, R&D spend and cash management. These measures provide information on the core R&D operations. Additional financial and non-financial KPIs may be adopted in due course.

Revenues

Revenue for both periods was £Nil. The last of the Company’s R&D collaborations concluded in September 2023.

Research and Development

R&D costs for 1H25 and 1H24, analysed by development project indication were as follows:

| Six months ended June 30 | 2025 | 2024 | |

| £’000 | £’000 | ||

| eRapa | |||

| Familial Adenomatous Polyposis | 251 | 175 | |

| Non-muscle Invasive Bladder Cancer | 127 | 95 | |

| Total eRapa | 378 | 270 | |

| Tolimidone | |||

| Type 1 Diabetes | 270 | 383 | |

| Total tolimidone | 270 | 383 | |

| MTX110 (panobinostat) | |||

| Diffuse Midline Glioma | - | - | |

| Recurrent Glioblastoma | 14 | 360 | |

| Medulloblastoma | - | - | |

| Total MTX110 (panobinostat) | 14 | 360 | |

| Other preclinical | 1 | 104 | |

| R&D overheads | 1,002 | 1,072 | |

| Total R&D | 1,665 | 2,189 | |

R&D costs in 1H25 reduced by £0.52 million, or 24%, to £1.67 million compared with £2.19 million in 1H24. The percentage of R&D costs as a percentage of total operating costs decreased to 41% in the period from 52%. The reduction in R&D costs in 1H25 reflects a reduction in spend of £0.56 million on the MAGIC-G1 study in rGBM and preclinical studies offset by an increase in expenditure (net of CPRIT grant income) on MTX230 (eRapa). The percentage of MTX230 (eRapa) costs that were able to be offset against grant funding during the period was 82% and we anticipate that over the life of the grant this will be 67%.

Administrative Costs

Administrative costs in 1H25 increased by £0.34 million, or 17%, to £2.38 million from £2.03 million in 1H24. The increase in administrative costs in 1H25 is driven by a foreign exchange charge of £0.40 million in the period compared to a £0.06 million gain in 2024. This was offset by a reduction in transaction related costs of £0.13 million. Transaction costs in the period included a £0.37 million non- cash upfront commitment fee for the ELOC.

Finance Income and Expense

Finance income in 1H25 and 1H24 included gains in respect of an equity settled derivative financial liability of £0.15 million (1H24: £0.75 million). The gains arose as a result of the fall in the Biodexa share price. In addition, the Company earned interest on cash deposits.

Finance expense in the period related to lease liabilities, discounted interest on deferred consideration and interest on the promissory note issued in December 2024.

Cash Flows

Cash outflows from operating activities in 1H25 were £3.30 million compared to £4.81 million in 1H24, driven by a net loss of £3.81 million (1H24: £3.31 million) and after negative working capital of £0.04 million (1H24: negative £0.87 million) and other positive non-cash items totalling £0.24 million (1H24: negative £0.63 million).

Net cash used in investing activities in 1H25 of £0.34 million (1H24: outflow £0.75 million) resulted from the payment of deferred consideration on the eRapa licence of £0.37 million (1H24: £0.85 million) offset by £0.04 million of interest received (1H24: £0.10 million).

Net cash generated from financing activities in 1H25 was £6.01 million (1H24: inflow £4.65 million), which was driven by £6.20 million proceeds from share issuances under the ELOC, £0.05 million net proceeds from a warrant inducement, offset by loan repayments (including interest) of £0.15 million and payments on lease liabilities of £0.10 million.

Overall, cash increased by £2.37 million in 1H25 compared to a decrease of £0.92 million in 1H24. This resulted in a cash balance at June 30, 2025 of £4.04 million compared with £5.05 million at June 30, 2024 and £1.67 million at December 31, 2024.

Going concern

Biodexa has experienced net losses and significant cash outflows from cash used in operating activities over the past years as it develops its portfolio. For the six months to June 30, 2025, the Group incurred a consolidated loss from operations of £3.81 million (1H24: £3.31 million) and negative cash flows from operating activities of £3.30 million (1H24: £4.81 million). As of June 30, 2025, the Group had accumulated deficit of £154.13 million.

The Group’s future viability is dependent on its ability to raise cash from financing activities to finance its development plans until commercialisation, generate cash from operating activities and to successfully obtain regulatory approval to allow marketing of its development products. The Group’s failure to raise capital as and when needed could have a negative impact on its financial condition and ability to pursue its business strategies.

The Directors believe there are adequate options and time available to secure additional financing for the Group and after considering the uncertainties, the Directors consider it is appropriate to continue to adopt the going concern basis in preparing these financial statements. The Group’s consolidated financial statements have therefore been presented on a going concern basis, which contemplates the realisation of assets and the satisfaction of liabilities in the normal course of business.

As at June 30, 2025, the Group had cash and cash equivalents of £4.03 million. The Directors have prepared cash flow forecasts and considered the cash flow requirement for the Group for the next three years including the period 12 months from the date of approval of this interim financial information. These forecasts show that further financing will be required before the second quarter of 2026 assuming, inter alia, that certain development programs and other operating activities continue as currently planned. Provided certain conditions are met, including the price of the Company’s ADSs quoted on NASDAQ being above $1.00, the Company may direct C/M to purchase ADSs and receive proceeds in accordance with a formula price for up to 36 months from January 2025. There is no guarantee that the Company will be able to use the ELOC to the extent necessary to finance the Company’s operations.

In the Directors’ opinion, the environment for financing of small and micro-cap biotech companies remains challenging. While this may present acquisition and/or merger opportunities with other companies with limited or no access to financing, as noted above, any attendant financings by Biodexa are likely to be dilutive. The Directors continue to evaluate financing options, including those connected to acquisitions and/or mergers, potentially available to the Group. Any alternatives considered are contingent upon the agreement of counterparties and accordingly, there can be no assurance that any of alternative courses of action to finance the Group would be successful.

This requirement for additional financing in the short term represents a material uncertainty that may cast significant doubt upon the Group’s ability to continue as a going concern. Should it become evident in the future that there are no realistic financing options available to the Group which are actionable before its cash resources run out then the Group will no longer be a going concern. In such circumstances, we would no longer be able to prepare financial statements under paragraph 25 of IAS 1. Instead, the financial statements would be prepared on a liquidation basis and assets would be stated at net realizable value and all liabilities would be accelerated to current liabilities.

Stephen Stamp

Chief Executive Officer and Chief Financial Officer

Consolidated Statements of Comprehensive Income

For the six month period ended June 30

| Note |

2025 unaudited £’000 |

2024 unaudited £’000 |

|

| Revenue | - | - | |

| Other income | 27 | - | |

| Research and development costs | (1,665) | (2,189) | |

| Administrative costs | (2,378) | (2,034) | |

| Loss from operations | (4,016) | (4,223) | |

| Finance income | 3 | 180 | 839 |

| Finance expense | 3 | (135) | (49) |

| Loss before tax | (3,971) | (3,433) | |

| Taxation | 165 | 125 | |

| Loss for the period attributable to the owners of the parent | (3,806) | (3,308) | |

| Items that will or may be reclassified subsequently to profit or loss: | |||

| Exchange gains arising on translation of foreign operations | 3 | - | |

| Total comprehensive loss attributable to the owners of the parent | (3,803) | (3,308) | |

| Loss per share | |||

| Basic and diluted loss per ordinary share – £ | 4 | £(0.0002) | £(0.001) |

The accompanying notes form part of these financial statements

Consolidated Statements of Financial Position

| Note |

As at June 30, 2025 unaudited £’000 |

As at December 31, 2024 £’000 |

||

| Assets | ||||

| Non-current assets | ||||

| Property, plant and equipment | 187 | 324 | ||

| Intangible assets | 5,645 | 5,646 | ||

| 5,832 | 5,970 | |||

| Current assets | ||||

| Trade and other receivables | 4,494 | 6,568 | ||

| Taxation | 462 | 573 | ||

| Cash and cash equivalents | 4,036 | 1,669 | ||

| 8,992 | 8,810 | |||

| Total assets | 14,824 | 14,780 | ||

| Liabilities | ||||

| Non-current liabilities | ||||

| Deferred consideration | 909 | 1,306 | ||

| Borrowings | - | 118 | ||

| 909 | 1,424 | |||

| Current liabilities | ||||

| Trade and other payables | 1,414 | 3,504 | ||

| Deferred consideration | 522 | 538 | ||

| Borrowings | 501 | 609 | ||

| Derivative financial liability | 42 | 383 | ||

| 2,479 | 5,034 | |||

| Total liabilities | 3,388 | 6,458 | ||

| Issued capital and reserves attributable to owners of the parent | ||||

| Share capital | 5 | 13,935 | 11,725 | |

| Share premium | 97,734 | 93,124 | ||

| Merger reserve | 53,003 | 53,003 | ||

| Warrant reserve | 894 | 894 | ||

| Foreign exchange reserve | 3 | - | ||

| Accumulated deficit | (154,133) | (150,424) | ||

| Total equity | 11,436 | 8,322 | ||

| Total equity and liabilities | 14,824 | 14,780 |

The accompanying notes form part of these financial statements

Consolidated Statements of Cash Flows

For the six month period ended June 30

| Note |

2025 unaudited £’000 |

2024 unaudited £’000 |

|

| Cash flows from operating activities | |||

| Loss for the period | (3,806) | (3,308) | |

| Adjustments for: | |||

| Depreciation of property, plant and equipment | 70 | 67 | |

| Depreciation of right of use asset | 69 | 68 | |

| Amortisation of intangible fixed asset | 1 | 1 | |

| Impairment of commission paid in advance on ELOC | 373 | - | |

| Finance income | 3 | (180) | (839) |

| Finance expense | 3 | 135 | 49 |

| Share-based payment expense | 97 | 150 | |

| Taxation | 4 | (165) | (125) |

| Foreign exchange losses | (157) | 2 | |

| Cash flows from operating activities before changes in working capital | (3,563) | (3,935) | |

| Decrease/(Increase) in trade and other receivables | 2,047 | (1,298) | |

| (Decrease)/Increase in trade and other payables | (2,090) | 426 | |

| Cash used in operations | (3,606) | (4,807) | |

| Taxes receipts | 302 | - | |

| Net cash used in operating activities | (3,304) | (4,807) |

Consolidated Statements of Cash Flows (continued)

For the six month period ended June 30

| Note |

2025 unaudited £’000 |

2024 unaudited £’000 |

|

| Investing activities | |||

| Purchases of property, plant and equipment | (2) | - | |

| Purchase of intangible assets | (372) | (852) | |

| Interest received | 35 | 98 | |

| Net cash generated from/(used in) investing activities | (339) | (754) | |

| Financing activities | |||

| Interest paid | (10) | - | |

| Amounts paid on lease liabilities | (95) | (93) | |

| Repayment of Promissory Note | (136) | - | |

| Share issues including warrants, net of costs | 5 | 6,251 | 4,738 |

| Net cash generated from/(used in) financing activities | 6,010 | 4,645 | |

| Net increase/(decrease) in cash and cash equivalents | 2,367 | (916) | |

| Cash and cash equivalents at beginning of period | 1,669 | 5,971 | |

| Cash and cash equivalents at end of period | 4,036 | 5,055 |

The accompanying notes form part of these financial statements

Consolidated Statements of Changes in Equity (unaudited)

| Note |

Share capital £’000 |

Share premium £’000 |

Merger reserve £’000 |

Warrant reserve £’000 |

Foreign exchange reserve £’000 |

Accumulated deficit £’000 |

Total equity £’000 |

|

| At January 1, 2025 | 11,725 | 93,124 | 53,003 | 894 | - | (150,424) | 8,322 | |

| Loss for the period | - | - | - | - | - | (3,806) | (3,806) | |

| Foreign exchange translation | - | - | - | - | 3 | - | 3 | |

| Total comprehensive loss | - | - | - | - | 3 | (3,806) | (3,803) | |

| Transactions with owners: | ||||||||

| Shares issued under ELOC agreement | 5 | 2,024 | 4,551 | - | - | - | - | 6,575 |

| Costs associated with ELOC agreement | 86 | (76) | - | - | - | - | 10 | |

| Shares issued on 15 May 2024 | 5 | 100 | 143 | - | - | - | - | 243 |

| Costs associated with share issue on 15 May 2024 | - | (8) | - | - | - | - | (8) | |

| Share-based payment charge | - | - | - | - | - | 97 | 97 | |

| Total contribution by and distributions to owners | 2,210 | 4,610 | 97 | 6,917 | ||||

| At June 30, 2025 | 13,935 | 97,734 | 53,003 | 894 | 3 | (154,133) | 11,436 |

| Note |

Share capital £’000 |

Share premium £’000 |

Merger reserve £’000 |

Warrant reserve £’000 |

Accumulated deficit £’000 |

Total equity £’000 |

|

| At January 1, 2024 | 6,253 | 86,732 | 53,003 | 3,457 | (144,767) | 4,678 | |

| Loss for the period | - | - | - | - | (3,308) | (3,308) | |

| Total comprehensive loss | - | - | - | - | (3,308) | (3,308) | |

| Transactions with owners: | |||||||

| Shares issued on February 15, 2023 | 5 | 1,242 | 3,730 | - | 1,690 | - | 6,662 |

| Costs associated with share issue on February 15, 2023 | - | (369) | - | (125) | - | (494) | |

| Shares issued on May 26, 2023 | 5 | 1,043 | 1,081 | - | (1,348) | - | 776 |

| Costs associated with share issue on May 26, 2023 | 151 | 68 | - | - | - | 219 | |

| Share-based payment charge | - | - | - | - | 195 | 195 | |

| Total contribution by and distributions to owners | 2,436 | 4,510 | - | 217 | 195 | 7,358 | |

| At June 30, 2024 | 8,689 | 91,242 | 53,003 | 3,674 | (147,880) | 8,727 |

The accompanying notes form part of these financial statements

Notes Forming Part of The Consolidated Unaudited Interim Financial Information

For the six month period ended June 30, 2025

1. Basis of preparation

The unaudited interim consolidated financial information for the six months ended June 30, 2025 has been prepared following the recognition and measurement principles of the International Financial Reporting Standards, International Accounting Standards and Interpretations (collectively IFRS) issued by the International Accounting Standards Board (IASB), and as adopted by the UK and in accordance with International Accounting Standard 34 Interim Financial Reporting (‘IAS 34’). The interim consolidated financial information does not include all the information and disclosures required in the annual financial information and should be read in conjunction with the audited financial statements for the year ended December 31, 2024.

The accounting policies adopted are consistent with those of the previous financial year and corresponding interim reporting periods.

Book values approximate to fair value at June 30, 2025, June 30, 2024 and 31 December 31, 2024.

The condensed interim financial information contained in this interim statement does not constitute statutory financial statements as defined by section 434(3) of the Companies Act 2006. The condensed interim financial information has not been audited. The comparative financial information for the six months ended June 30, 2024 and the year ended December 31, 2024 in this interim financial information does not constitute statutory financial statements for that period or year. The statutory financial statements for December 31, 2024 have been delivered to the UK Registrar of Companies. The auditor’s report on those accounts was unqualified and did not contain a statement under section 498(2) or 498(3) of the Companies Act 2006. The auditor’s report did draw attention to a material uncertainty related to going concern and the requirement, as of the date of the report, for additional funding to be raised by the Company by the fourth quarter of 2025.

Biodexa Pharmaceutical’s annual reports may be downloaded from the Company’s website at https://biodexapharma.com/investors/financial-reports-and-presentations/#financial-reports or a copy may be obtained from 1 Caspian Point, Caspian Way, Cardiff CF10 4DQ.

Going Concern – material uncertainty

Biodexa has experienced net losses and significant cash outflows from cash used in operating activities over the past years as it develops its portfolio. For the six months to June 30, 2025, the Group incurred a consolidated loss from operations of £3.81million (1H24: loss £3.31 million) and negative cash flows from operating activities of £3.30 million (1H24 £4.81 million). As of June 30, 2025, the Group had accumulated deficit of £154.13 million.

The Group’s future viability is dependent on its ability to raise cash from financing activities to finance its development plans until commercialisation, generate cash from operating activities and to successfully obtain regulatory approval to allow marketing of its development products. The Group’s failure to raise capital as and when needed could have a negative impact on its financial condition and ability to pursue its business strategies.

The Directors believe there are adequate options and time available to secure additional financing for the Group and after considering the uncertainties, the Directors consider it is appropriate to continue to adopt the going concern basis in preparing these financial statements. The Group's consolidated financial statements have been presented on a going concern basis, which contemplates the realization of assets and the satisfaction of liabilities in the normal course of business.

As at June 30, 2025, the Group had cash and cash equivalents of £4.04 million. The Directors have prepared cash flow forecasts and considered the cash flow requirement for the Group for the next three years including the period 12 months from the date of approval of this interim financial information. These forecasts show that further financing will be required before the second quarter of 2026 assuming, inter alia, that certain development programs and other operating activities continue as currently planned. Provided certain conditions are met, including the price of the Company’s ADSs quoted on NASDAQ being above $1.00, the Company may direct C/M to purchase ADSs and receive proceeds in accordance with a formula price for up to 36 months from January 2025. There is no guarantee that the Company will be able to use the ELOC to the extent necessary to finance the Company’s operations.

In the Directors’ opinion, the environment for financing of small and micro-cap biotech companies remains challenging. While this may present acquisition and/or merger opportunities with other companies with limited or no access to financing, as noted above, any attendant financings by Biodexa are likely to be dilutive. The Directors continue to evaluate financing options, including those connected to acquisitions and/or mergers, potentially available to the Group. Any alternatives considered are contingent upon the agreement of counterparties and accordingly, there can be no assurance that any of alternative courses of action to finance the Company would be successful.

This requirement for additional financing in the short term represents a material uncertainty that may cast significant doubt upon the Group’s ability to continue as a going concern. Should it become evident in the future that there are no realistic financing options available to the Group which are actionable before its cash resources run out then the Group will no longer be a going concern. In such circumstances, we would no longer be able to prepare financial statements under paragraph 25 of IAS 1. Instead, the financial statements would be prepared on a liquidation basis and assets would be stated at net realizable value and all liabilities would be accelerated to current liabilities.

2. Accounting for eRapa and CPRIT grant

The License and Collaboration Agreement (“LCA”) entered into with Emtora in April 2024 meets the definition of a Joint Arrangement under IFRS 11, specifically related to the FAP program.

A jointly controlled escrow account was established on completion of the LCA. All FAP program transactions are processed through the escrow account, including the Company’s deposits of matching funds, as set out in the agreement, the receipt of grant funding from CPRIT and the payment of eligible R&D expenses. Although the CPRIT grant and R&D supplier contracts are with Emtora, the joint arrangement nature of the LCA results in Emtora being deemed to be acting as the Company’s agent. Accordingly, the Company recognises 100% of the grant and 100% of the R&D expenditure. The CPRIT grant recognised is on a 1 for 2 match. In accordance with the Company’s accounting policy, the grant, as it is the re-imbursement of directly related costs, is credited to R&D costs in the same period in The Statements of Comprehensive Income. The escrow account is recognised within prepayments, CPRIT grant received in advance is recognised within deferred revenue and any grant not yet received is recognised in accrued income.

In 1H25 the company recognised R&D costs of £0.5 million (1H24: £0.2 million) on the FAP project, made up of expenditure of £2.6 million (1H24: £0.5 million) netted against CPRIT grant of £2.1 million (1H24: £0.3 million).

The balances in relation to the FAP project as at June 30 were as follows:

|

June 30, 2025 unaudited £’000 |

June 30, 2024 unaudited £’000 |

|

| Prepayments* | 2,751 | 6,114 |

| Accrued revenue | 599 | - |

| Deferred revenue | - | (1,468) |

* prepayment reflects only the escrow account balance

3. Finance income and expense

|

Six months ended June 30, 2025 unaudited £’000 |

Six months ended June 30, 2024 unaudited £’000 |

|

| Finance income | ||

| Interest received on bank deposits | 32 | 86 |

| Other interest | 3 | 2 |

| Gain on equity settled derivative financial liability | 145 | 751 |

| Total finance income | 180 | 839 |

The gain on the equity settled derivative financial liability in 1H25 and 1H24 arose as a result of the fall in the Biodexa share price.

|

Six months ended June 30, 2025 unaudited £’000 |

Six months ended June 30, 2024 unaudited £’000 |

|

| Finance expense | ||

| Interest expense on lease liabilities | 6 | 11 |

| Interest expense on deferred consideration | 86 | 38 |

| Other loans | 43 | - |

| Total finance expense | 135 | 49 |

4. Loss per share

Basic loss per share amounts are calculated by dividing the net loss for the period from continuing operations, attributable to ordinary equity holders of the parent company, by the weighted average number of ordinary shares outstanding during the period. As the Group made a loss for the period the diluted loss per share is equal to the basic loss per share.

|

Six months ended June 30, 2025 unaudited £’000 |

Six months ended June 30, 2024 unaudited £’000 |

|

| Numerator | ||

| Loss used in basic EPS and diluted EPS: | (3,806) | (3,308) |

| Denominator | ||

| Weighted average number of ordinary shares used in basic EPS | 25,267,266,823 | 3,280,798,115 |

| Basic and diluted loss per share: | £(0.0002) | £(0.001) |

At a General Meeting on 11 June 2025, shareholders approved the subdivision and redesignation of the Company’s Issued Ordinary Shares of £0.00005 each into to one Ordinary Share of £0.000001 each and 49 ‘D’ Deferred Shares of £0.000001 each. The ‘D’ Deferred Shares have limited rights and are effectively valueless. The share sub-division and redesignation did not impact the calculation of the denominator as the number of Issued Ordinary Shares did not change.

The Company has considered the guidance set out in IAS 33 in calculating the denominator in connection with the issuance of Pre-Funded and Abeyance Shares. Management have recognised the warrants from the date of grant rather than the date of issue of the corresponding Ordinary Shares when calculating the denominator.

The Group has made a loss in the current and previous periods presented, and therefore the options and warrants are anti-dilutive. As a result, diluted earnings per share is presented on the same basis as basic earnings per share.

5. Share capital and reserves

Authorised, allotted and fully

paid – classified as equity

As at June 30, 2025 unaudited

Number

As at June 30, 2025 unaudited

£

As at December

31, 2024

Number

As at December 31, 2024

£

Ordinary shares of £0.000001 each

61,952,308,922

61,952

6,685,918,922

334,296

‘A’ Deferred shares of £1 each

1,000,001

1,000,001

1,000,001

1,000,001

‘B’ Deferred shares of £0.001 each

4,063,321,418

4,063,321

4,063,321,418

4,063,321

| ‘C’ Deferred shares of £0.00005 each | 4,063,321,418 | 4,063,321 | 4,063,321,418 | 4,063,321 |

126,547,389,518

6,327,370

126,547,389,518

6,327,370

‘D’ Deferred shares of £0.000001 each

2,482,747,137,178

2,482,747

-

-

Total

13,935,391

11,724,988

Ordinary and deferred shares were recorded as equity.

At a General Meeting on 11 June 2025, shareholders approved the subdivision and redesignation of the Company’s Issued Ordinary Shares of £0.00005 each into to one Ordinary Share of £0.000001 each and 49 ‘D’ Deferred Shares of £0.000001 each. The ‘D’ Deferred Shares have limited rights and are effectively valueless.

As at June 30, 2025 and December 31, 2024 the Company had 17,415 pre-funded warrants outstanding over ADS’s. These are recognised in the warrant reserve until exercise.

In accordance with the Articles of Association for the Company adopted on 11 June 2025, the share capital of the Company consists of an unlimited number of ordinary shares of nominal value £0.000001 each. Ordinary and deferred shares were recorded as equity.

6. Related party transaction

The Directors consider there to be no related party transactions during the periods reported other than Directors Remuneration.

7. Contingent liabilities

The Company is in a dispute with a former advisor over fees. In the event the Company is unsuccessful in its dispute the amount due to the vendor is approximately $1.16 million, of which $0.82 million would be payable in cash and the remainder amount in warrants exercisable for our ADSs. The Directors note that in the event of an unfavourable resolution the Company would not be able to recoup the loss from another party.

8. Events after the reporting date

On July 15, 2025, the Company announced a ratio change on its ADSs from one (1) ADS representing ten thousand (10,000) ordinary shares, to the new ratio of one (1) ADS representing one hundred thousand (100,000) ordinary shares (the "Ratio Change"). The effective date of the Ratio Change was July 31, 2025.

Legal Disclaimer:

EIN Presswire provides this news content "as is" without warranty of any kind. We do not accept any responsibility or liability for the accuracy, content, images, videos, licenses, completeness, legality, or reliability of the information contained in this article. If you have any complaints or copyright issues related to this article, kindly contact the author above.